Introduction

In today’s complex financial landscape, the term “money hoarder” often comes up in discussions about personal finance and economic behavior. Specifically, a money hoarder is someone who accumulates and holds onto cash obsessively, frequently opting to keep it in physical form rather than investing or spending it. This behavior reflects broader psychological issues, such as financial anxiety and insecurity, which can be traced back to personal experiences with financial instability.

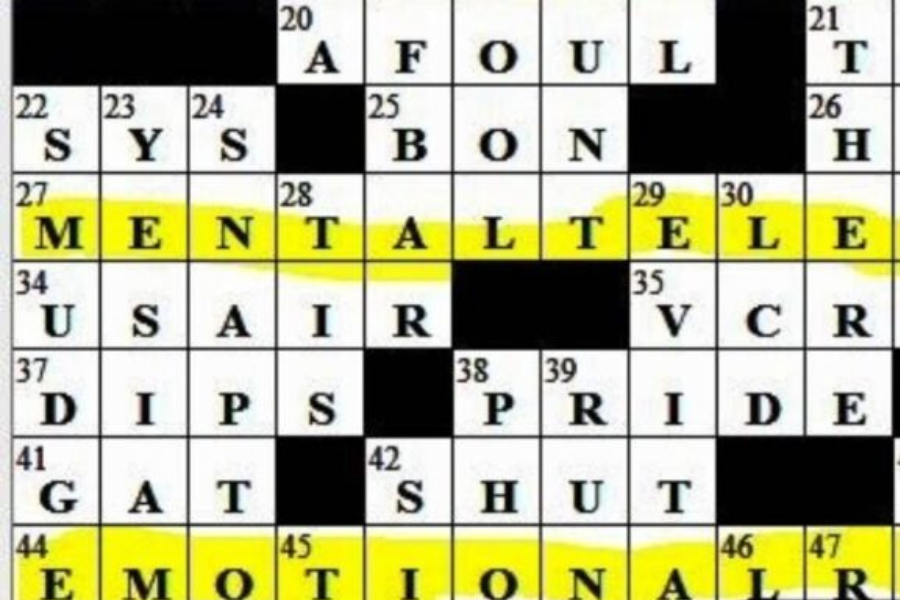

The Connection to the NYT Mini Crossword

The term “money hoarder” finds its place in popular culture, particularly in crossword puzzles like the New York Times Mini Crossword, where it commonly serves as a clue synonymous with “miser.” The word “miser” evokes images of individuals who are excessively frugal and reluctant to spend their wealth, despite potential benefits. This cultural reference taps into long-standing archetypes of stingy characters, such as Ebenezer Scrooge from Charles Dickens’ A Christmas Carol, who hoard their wealth while neglecting the joys of life.

Crossword puzzles, particularly those curated by the New York Times, enjoy immense popularity due to their ability to engage and challenge solvers. Clues like “money hoarder” serve not just as tests of vocabulary but also require solvers to draw upon cultural references and historical contexts. This connection enriches the experience, as it reflects societal attitudes toward wealth and frugality.

Exploring the Psychological Underpinnings of Money Hoarding

The phenomenon of money hoarding is closely linked to psychological constructs such as the scarcity mindset. A scarcity mindset is a state of mind where individuals believe there is never enough—be it money, resources, or opportunities. This perspective often leads to hoarding behaviors, especially for those with histories of financial instability. The fear of not having enough in the future can compel individuals to cling to their money, prioritizing saving over investing or spending, even when the latter could lead to greater long-term benefits.

Individuals who have faced financial hardship in their past, such as growing up in poverty or experiencing significant financial loss, may develop a deep-seated mistrust of financial systems. This mistrust can manifest in the form of a money hoarder who feels that cash in hand is safer than funds in a bank. The act of keeping large amounts of cash might provide a sense of immediate safety, yet it can also perpetuate anxiety about financial insecurity.

The Emotional Landscape of Money Hoarding

While hoarding money can create a sense of security, it often leads to a cycle of anxiety and emotional distress. On the one hand, having cash on hand can instill confidence that one can handle emergencies. On the other hand, the incessant worry about not having enough can create chronic stress.

This emotional turmoil can be exacerbated by a pervasive mistrust of banks and financial institutions. Money hoarders may harbor fears about losing their savings or losing control over their finances, which reinforces their inclination to keep money in physical cash. This deep mistrust, combined with the anxiety of financial instability, can create a complex relationship with money that is difficult to untangle.

Real-World Implications of Money Hoarding

The act of hoarding cash often creates a false sense of security, but it comes with significant drawbacks. When individuals keep large sums of money in cash, they miss out on potential financial growth. Unlike cash, money that is saved in bank accounts or invested can earn interest, increasing in value over time. In contrast, hoarded cash loses purchasing power due to inflation, meaning that money saved today could be worth less in the future.

Financial experts consistently advise against hoarding cash, arguing that it is an ineffective long-term strategy. Instead, they recommend a balanced approach to financial management. This approach involves maintaining a small cash reserve for emergencies while investing the majority of one’s savings in accounts that yield interest or in diversified assets. By doing so, individuals can combat inflation and ensure their money works for them over time.

Personal Stories Highlighting Financial Trauma

Many individuals who hoard money do so as a response to past financial trauma. For example, someone who grew up in a financially unstable environment might develop habits of saving every penny, driven by a fear of returning to a state of hardship. These personal narratives underscore the lasting impact of financial instability and how it shapes one’s behavior with money.

Such stories illustrate the complexities of money hoarding, revealing how past experiences can lead to an unhealthy relationship with finances. Acknowledging these influences can help individuals recognize their patterns and seek healthier ways to manage their money.

Expert Perspectives on Money Hoarding

Financial planners and experts generally agree that hoarding cash is not the most effective financial strategy. While it may offer a sense of immediate security, it also prevents individuals from taking advantage of opportunities for growth. Inflation erodes the value of cash over time, meaning that individuals risk losing wealth simply by keeping it stagnant.

Experts often suggest that a well-rounded financial plan should include a mix of liquid cash for emergencies, investments in stocks or bonds, and savings in high-interest accounts. This diversified approach not only mitigates the effects of inflation but also ensures that money is actively growing over time.

For those who struggle with the tendency to hoard money, financial planners recommend implementing automatic transfers to savings or investment accounts. This practice can help ease the anxiety associated with parting with cash while still ensuring that one’s money is working effectively. Consulting with a financial advisor can also help individuals create personalized plans that align with their comfort levels and financial goals.

Strategies for Overcoming Money Hoarding

Addressing the habit of hoarding money requires a shift in mindset from one of scarcity to one of abundance. Here are several actionable strategies that can help:

Build Trust in Financial Systems: Start by gradually increasing trust in financial institutions. Opening a savings account and depositing a portion of cash reserves can be an excellent first step.

Educate Yourself About Investments: Understanding the benefits of investing and how money can grow over time can alleviate fears associated with spending. Knowledge about stocks, bonds, and high-interest savings accounts empowers individuals to make informed decisions.

Set Clear Financial Goals: Having specific, measurable financial objectives can motivate individuals to move away from hoarding behaviors. Goals such as saving for retirement, purchasing a home, or building an emergency fund can redirect focus toward productive financial habits.

Seek Professional Guidance: If money hoarding stems from deep-seated financial trauma, consider seeking therapy or counseling. Addressing underlying issues can facilitate a healthier relationship with money and pave the way for more constructive financial behaviors.

Practice Mindfulness in Spending: Recognize when spending can enhance your quality of life. Allocating funds for experiences or necessities can help break the cycle of hoarding, encouraging a more balanced view of money.

Conclusion: Balancing Security and Financial Growth

Finding the right balance between feeling secure and making wise financial decisions is crucial. While it’s important to keep some cash on hand for emergencies, relying solely on cash can significantly hinder financial growth. By diversifying savings and investments, individuals can maintain a sense of security while ensuring their money is actively working for them.

Final Thoughts

Evaluate your current financial habits and consider whether they are helping or hindering your financial future. If you discover that you are a money hoarder—especially a money hoarder NYT—acting out of fear or mistrust, it may be time to explore alternative financial strategies. Seeking professional advice from financial planners or counselors can provide valuable guidance as you work toward a more balanced and productive approach to managing your money.

By understanding the psychological and emotional aspects of money hoarding, as well as the practical implications of such behavior, individuals can take proactive steps to foster a healthier relationship with their finances. Ultimately, it’s about achieving peace of mind while also capitalizing on opportunities for growth and financial stability.

Stay in the know with the latest news and updates on Latestbuzz.co.uk